20+ Arkansas Paycheck Calculator

New hires must be. Just enter the wages tax withholdings and other.

Thinkful

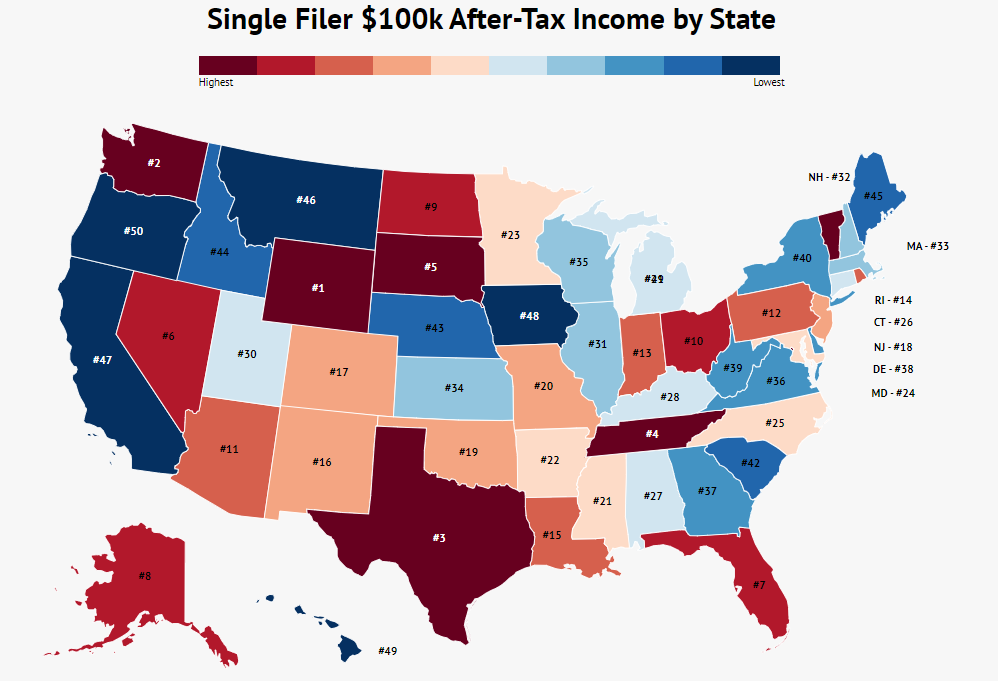

Arkansas has three state income tax brackets ranging from 2 to 590 and the rate applied does not vary based on marital.

. Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings helping you plan your expenses savings and investments better. Web Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Use our simple paycheck calculator to estimate your net or take home pay after taxes as an hourly or salaried employee in Arkansas.

Web The Arkansas Paycheck Calculator offers several benefits. Web You pay tax as a percentage of your income in layers called tax brackets. Web Use our free Arkansas paycheck calculator to determine your net pay or take-home pa y by inputting your period or annual income along with the necessary.

Web How to calculate annual income. Web Arkansas State Income Tax Calculation. Dollar Amount Add another deduction Fringe Benefits Add Fringe benefit Gross Pay 0 Income taxes 0 0 FICA taxes 0.

Web The state income tax rate in Arkansas is progressive and ranges from 0 to 49 while federal income tax rates range from 10 to 37 depending on your income. Calculated using the Arkansas State Tax Tables and Allowances for 2024 by selecting your filing status and entering your Income for. As your income goes up the tax rate on the next layer of income is higher.

Use our paycheck tax. 20 1 Ravens 34-10 over 4 Texans. Web Arkansas Hourly Paycheck Calculator Results.

The results are broken up into three sections. Web Arkansas Paycheck Calculator 2023 Discover your net pay with the Arkansas Paycheck Calculator an easy-to-use tool that helps you accurately. Web Federal Paycheck Calculator Photo credit.

Just ask the large retailer with a name starting with the letter W. It provides a clear breakdown of your salary helping you understand where your money is going and how many. Simply enter their federal and state W.

Web Arkansas Paycheck Calculator Calculate your take-home pay after federal Arkansas taxes Updated for 2023 tax year on Dec 05 2023 What was updated. Below are your Arkansas salary paycheck results. Web Arkansas Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Paycheck Calculator Pay breakdown. Arkansas is a great state to start a business. This game was tied at halftime but the Ravens blew it open during a second half where they outscored.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Arkansas. Web Arkansas Salary Paycheck Calculator Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Web Arkansas Salary Paycheck Calculator. Web The Arkansas Paycheck Calculator is a powerful tool designed to help employees and employers in Arkansas accurately calculate the net take-home pay after deductions. Web Choose a calculation method.

Web Arkansas Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. For example if an. Web Saturday Jan.

Timecamp

1

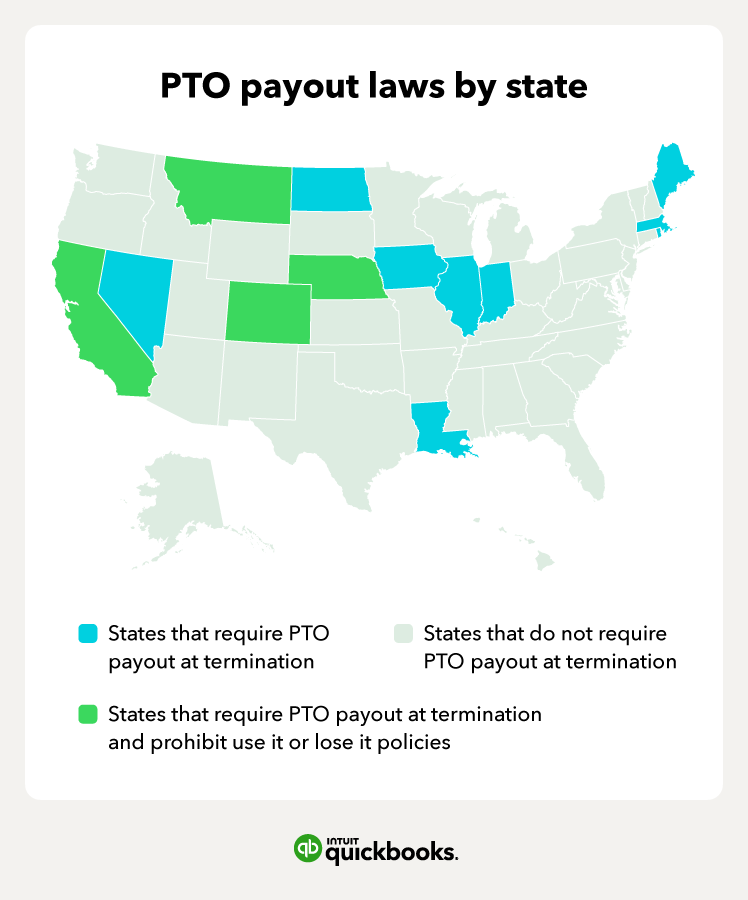

Quickbooks Intuit

Luxury Presence

Salary Explorer

Omnipresent

1

Mypaycalculator Net

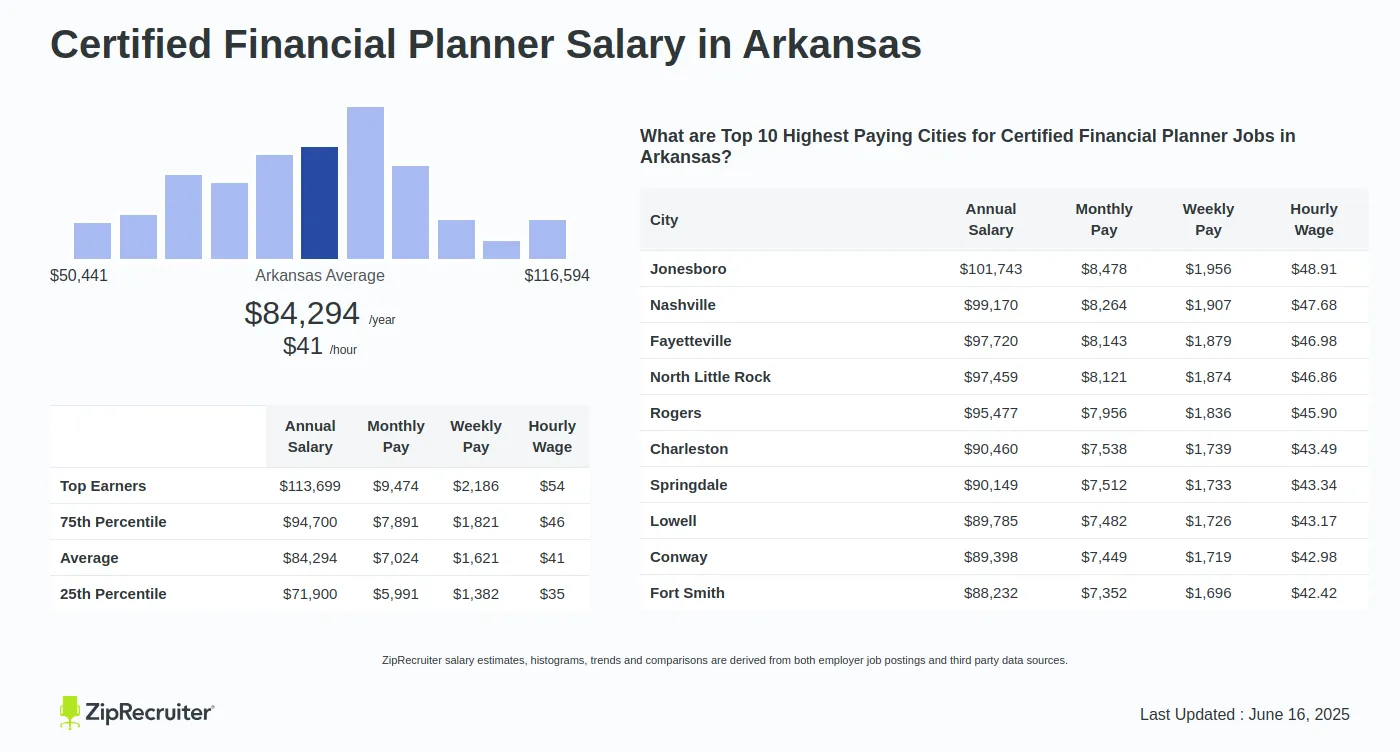

Ziprecruiter

Zippia

Timecamp

Quora

Investomatica

Softwaresuggest

Niche

Google Play

Issuu